Despite the fact that a housing marketcrash is highly unlikely, the government still has a fiduciary responsibility to protect new home owners and the economic fundamentals that helped Canadians survive the 2008 US market correction, unscathed. That responsibility rests with the Office of the Superintendent of Financial Institutions (OSFI). One of OSFI’s core mandates is to oversee the regulatory

environment assessing risk and proactively implementing early interventions and corrective measures. Although their decisions may not be popular, they are indeed necessary. In order to understand the new proposed changes, you’ll need a crash course on the current

landscape. In the market today, there are three types of mortgages as it related to default insurance:

- Insured

Owner or non-rent paying family occupied residences where the customer has

purchased a home with less that 20% down, secured default insurance at their own cost

and transacted at a price point of less that $1,000,000. These mortgages are stress

tested with a maximum amortization of 25 years. - Insurable

An insurable mortgage is where a mortgage is qualified based on the insured mortgage

guidelines however, the cost of the default insurance is paid for by the lender. The

lender chooses to do so in order to back-end-insure the mortgage to increase its

marketability in raising new capital for lending. - Uninsured

An uninsured mortgage is one where default insurance can not be secured and is often

funded off of the balance sheet of the lender. These mortgages are:

- In excess of $1,000,000

- Can be non-owner occupied

- Have amortization in excess of 25 years

- Can accommodate refinances

- Can only finance up to a maximum of 80% of the property’s value

Over the course of the last 10 years, the Department of Finance and OSFI have introduced many measures to allow for Canadian financial institutions to continue to put home ownership within the grasp of Canadians resulting in 68.5% achieving home ownership. The majority of these changes were directed at default insured clients, the segment of consumers that represented the highest risk. These changes, often perceived as losses, weeded out marginal buyers by imposing:

- Higher down payment requirements increasing the buyers stake in the purchase

- Shorter amortization allowing to shorten the risk exposure

- Introduction and fine tuning of the Stress Test to ensure that each buyer had the financial

resources to handle higher payments at renewal by qualifying based on a higher

standardized rate - Elimination of the default insured refinance program to make sure that Canadian

consumers still maintained adequate equity in their home - To minimize speculative activity:

They increased the minimum down payment for rentals to 20%

Limit the number of default insured mortgages per consumer

The introduction of such measures increased the barrier for entry into home ownership and discouraged speculative buyers. Let’s put this into perspective:

A first time buyer who purchases a new home with 5% on a $500,000 purchase will need a mortgage of $475,000. The default insurance cost at that level is 4% which equates to $19,000. This amount is added onto the mortgage which increases the total mortgage amount to $494,000. That means the day this customer moves into this home, their equity will be worth $6,000. If the market were to correct by 10%, the real estate value would be worth $450,000 and the customer would be in a negative equity position.

Someone is far more likely to consider insolvency measures such as consumer proposals and bankruptcy if they’ve got no equity to remain financially vested in the transaction.

As you can see in this illustration, the default insurers have the most to lose in a market correction which is likely why CMHC in spring of 2020 predicted a large market correction of 10-18% over the course of the next 12 months. Those with the least amount of equity represented the greatest risk. Therefore, by sharing a pessimistic outlook, would deter marginal buyers from transacting.

Given the expensive cost of default insurance and more stringent lending guidelines, if today’s consumer is looking to retain their equity and stretch their purchasing power they would need to solve for the 20% down payment. This is where the bank of mom-and-dad has enabled today’s consumer, most notably millennials in securing home ownership outside the confines of default

insurance.

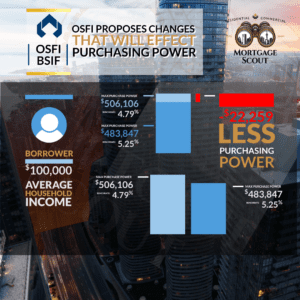

And this now brings us to the new proposed changes that are being tabled for June 1st, a new higher minimum qualifying guidelines for uninsured mortgages. This new guideline that will apply to all uninsured mortgages will mean that anyone that fits within these parameters will be qualifying based on the higher of the contract rate plus 2% or a new benchmark rate of 5.25%. The table noted below illustrates an example for an average household earning $100,000 in annual income. In this particular case, a move from the current benchmark rate of 4.79% to the higher new proposed rate of 5.25% will result in a loss of $22,259 (4.4%) in purchasing power for customers who are looking to consider uninsured mortgage solutions.

Should this change put your dream home just outside your reach, it’s important to note that not all lenders are federally regulated. Credit unions are provincially regulated and fall outside of federal governance. A select number of credit unions continue to offer solutions based on contract rates to help stretch your purchasing power, but important to note that they do so for a rate premium.

May 21st UPDATE

Hot off the PRESS with a Surprise TWIST!

As anticipated, yesterday, May 20th, OSFI confirmed that they will be launching their new Stress test rate of 5.25% on all un-insurable mortgages. What we didn’t expect, which came as a surprise with NO advance notice was Deputy Prime Minister and Finance Minister, Chrystia Freeland announcing:

That will result in an average reduction in 4% of purchasing power for all buyers in the insured, insurable and un-insurable pool of mortgages.

Given the ever-changing landscape, it’s important to be informed and have options. Under the circumstances the diversity of our lenders, the number of institutions at our disposal and the fact that some of our lenders aren’t affected by these changes give us, mortgage brokers a unique advantage over solutions offered by conventional banks.

To help you stay ahead of these changes, give us a call today and get the competitive advantage you need to win in today’s challenging market!