The New Canadian Mortgage Charter: A Comprehensive Overview

In November 2023, the Canadian government introduced the Canadian Mortgage Charter as part of its 2023 Fall Economic Statement. This Charter is a pivotal move

Navigating the New Landscape: Understanding Mortgage Trends and Opportunities in 2024

As we embark on 2024, the mortgage landscape is evolving rapidly, with significant shifts in rates, policies, and market dynamics. This article delves into the

Surging Bond Yields and the Canadian Mortgage Market

The Ripple Effect Recent economic trends have showcased surging bond yields in Canada, a phenomenon that has a significant ripple effect on the mortgage market.

Adapting to Change: The Shift in the Canadian Mortgage Landscape

The Canadian mortgage market is dynamic and subject to changes influenced by a variety of factors. Recently, a notable shift in the Canadian mortgage landscape

A Deep Dive into Variable Rate Mortgages in Canada

Navigating the Financial Waves In the realm of home financing, Variable Rate Mortgages (VRM) emerge as a dynamic choice adapting to the economic tide. In

Seizing Opportunities: Thriving in a Buyer’s Market in Canada

Real estate market dynamics can fluctuate between a seller’s market and a buyer’s market. Currently, certain regions in Canada are experiencing what is known as

Navigating New Real Estate Listings in Canada

The pursuit of the perfect home or investment property begins with a thorough exploration of new real estate listings in Canada. The market is vibrant

Securing Stability: Advantages of a Fixed-Rate Mortgage in Canada

In the realm of real estate financing, choosing the right type of mortgage is crucial. One popular choice among Canadians is the fixed-rate mortgage. Understanding

Demystifying Mortgage Approval in Canada

Securing a mortgage is a significant step towards homeownership. However, the process can often seem daunting, especially for first-time homebuyers. Understanding the process of mortgage

A Look at Mortgage Rate Forecast in Canada

What the future holds The Canadian mortgage market is subject to changes influenced by numerous factors, both domestic and global. One aspect that both potential

Navigating Mortgage Rate Hikes in Canada: What You Need to Know

The Canadian mortgage market is in a state of flux, with mortgage rate hikes in Canada becoming a reality. For many prospective homeowners and real

Overcoming Housing Market Headwinds in Canada

A Comprehensive Guide The Canadian housing market is a dynamic and complex landscape characterized by its regional variances and impacted by both domestic and global

Navigating the Canadian Housing Market

with Trusted Mortgage Advisory Services In the constantly evolving Canadian mortgage market, having a reliable guide can make all the difference. That’s where professional mortgage

The Rising Costs of Homeownership: Existing vs. New Mortgage Payments Over Time

The Changing Landscape The current landscape of homeownership is filled with challenges and opportunities. One notable development is the rising cost of mortgage payments, a

Understanding Your Purchasing Power in Today’s Canadian Mortgage Market

Rate (%) Potential Mortgage Amount ($) 2.99% $536,178 3.99% $481,040 4.99% $434,428 5.99% $394,776 In the complex and fluctuating landscape of the Canadian real estate

Mortgages for Investment Properties

Introduction Despite the changing tides in the economy, the dream of owning an investment property remains alive and well. Contrary to popular belief, periods of

Mortgages for the Self Employed

Did you know? Approximately 15%+ of Canadians are self-employed, making this an important segment in the mortgage and financing space. When it comes to self-employed

Home Buyers Guide

Whether you’re looking at a condo, townhouse, rancher or a two-story property, there is nothing quite like your first home! However, the mortage process can

7 Steps for Mortgage Prep

Step 1 – Your Score Whether you qualify for a mortgage through a bank, credit union or other financial institution, you should be aiming for

Understanding Your Credit Score

Understand Your Credit Score What makes up your Score? Credit Bureaus keep their exact proprietary scoring models secret, but they generally follow this breakdown:

Finding Your Perfect Home Type

When it comes to finding your perfect home, there are so many more options for potential homeowners! From a single-family dwelling to a townhouse to

5 Roadblocks to Your Approval, You Should Know!

When buying a home, there is nothing worse than having your mortgage broker or lawyer call and say “there is a problem”. If you have

Bank of Canada: A History of Canadian Prime

The Bank’s Beginnings In 1933, Criticism of Canada’s banking system fueled a movement in Prime Minister R.B. Bennett’s parliament stoking concern that Canada lacked

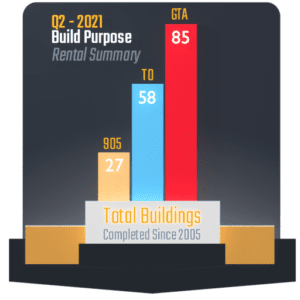

Urbanation 2021 Q2 Analysis of Rental Market

“The GTA rental market recovery began in earnest during the second quarter, with a surge in leases, reduced vacancy, and an increase in rents as

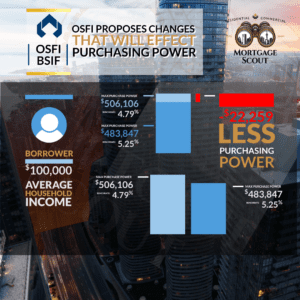

New Stress Test: What you need to know?

Despite the fact that a housing marketcrash is highly unlikely, the government still has a fiduciary responsibility to protect new home owners and the economic

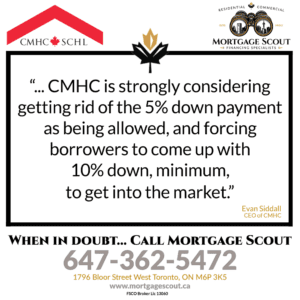

Could this mark the END of the minimum 5% down payment for homebuyers⁉️

BREAKING NEWS: In a recent Parliamentarian debrief of the House of Commons standing Finance Committee, Evan Siddall, President and CEO …

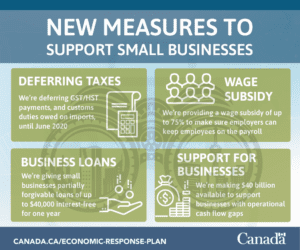

Mortgage Scout: COVID-19 Financial Assistance Resource for Businesses (Self Employed)

Canada Emergency Business Account for Small Business (CEBA) On March 27, Prime Minister Trudeau announced additional measures to support …

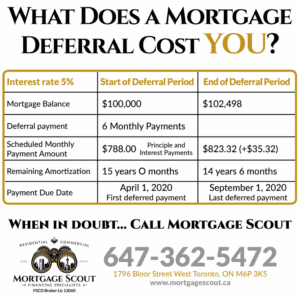

So what does it ACTUALLY cost to defer your mortgage payments?

According to information published by Statistics Canada, over $9.5 million of Canada’s $14.1 million households owned their home accordi…

Mortgage Scout: COVID-19 Financial Assistance Resource for Individuals

Updated COVID-19 Financial Assistance Guide reflective of the current changes.

If I only had MORE time?

As the realities of the COVID-19 global pandemic begin to set in, we find ourselves challenged with our new norms. The challenging, but …

Breaking News: Changes to the Bank of Canada Stress Test

Effective April 6th 2020, the Stress Test qualifying rate will decrease for Insured Mortgages. Mortgage default insurance is required wh…

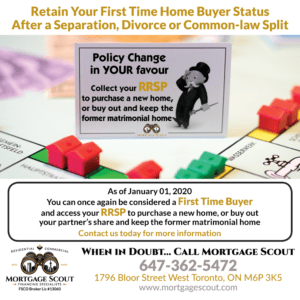

There’s life after separation!

Separated and need a Downpayment? Over the years we’ve found clients taking initial steps in the divorce process encountering challenges…

Adapting to our changing Environment?

In an effort to support our community and prevent the spreading of the COVID-19 virus, we’ve temporarily closed our physical offices to t…

Today’s COVID-19 Landscape: An Economist’s Perspective [Benjamin Tal]

With our world today being filled with misinformation and fake news, it’s refreshing to gain some quality insight into the economic impac…