According to information published by Statistics Canada, over $9.5 million of Canada’s $14.1 million households owned their home according to data gathered in 2016. That puts us at a homeownership rate of 67.8%.

Given today’s economic climate and uncertainty as to when life will return to normal, that leaves us wondering whether payment deferral is something we should consider. To shed some light on the matter, we’ve published this post to share some insight and help demystify the process.

Although the Big 6 banks have all agreed to support clients through these difficult times by allowing them to defer their mortgage payments (up to 6 months worth of payments), each of these institutions, as well as the balance of the industry counterparts, will exercise some discretion as to how long they will grant customers given their individual circumstance. In some cases, lenders have broken these 6 months up into multiple intervals where clients looking for the benefits of the full 6 months will need to send in subsequent requests.

Over the course of the last week, all of these institutions have been flooded with phone calls, as many as 20,000 on a daily basis not to mention countless emails and in-person branch visits. To streamline the process, lenders have been publishing web-based self-service resources to handle these requests and try and provide support for those most affected by the impact of COVID-19. Understanding the urgency of today’s need and in an effort to get support to those that need it to most, these self-service web forms have been simplified to a few short questions to eliminate hurdles and improve the administration of these requests.

Anyone considering a payment deferral needs to understand two important facts about the impact of a payment deferral:

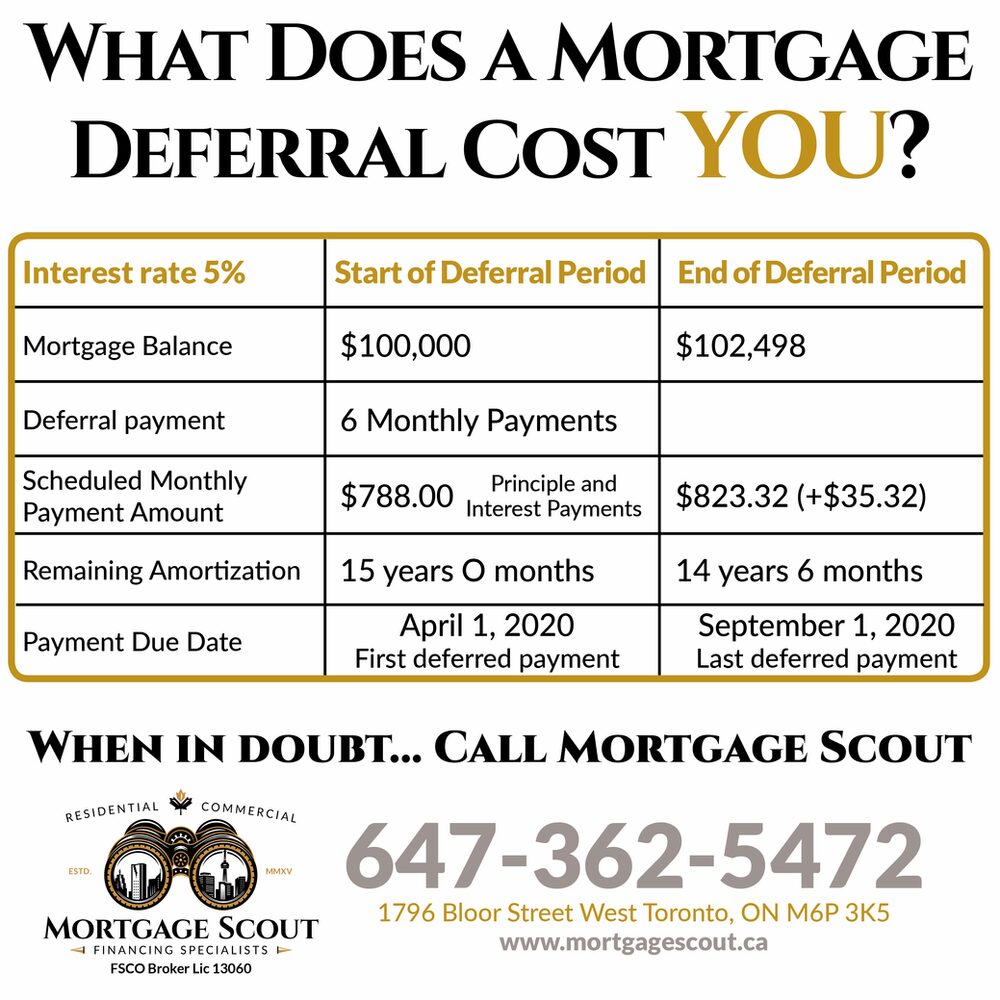

- A deferral of payment could increase the amortization (life of your mortgage) if the monthly payment isn’t increased after the deferral period

- The deferred mortgage payment will accrue interest, which although not an out-of-pocket expense, will cost you more interest over the life of your mortgage

Sincere thanks to our partners at Scotiabank for providing the illustration details noted in the title image.

RBC has also put together a payment deferral calculator to help you calculate a more specific cost relative to your personal mortgage circumstances which we’ve included below.

In summary, if you’re concerned about short term impact of the quarantine on your family’s cash flow, this is perhaps something you should consider. For investors who’ve encountered difficulty due to rent payments in default, this tool could also prove to be of value. Otherwise, provided savings and cash flow are in order, our advice would be to continue to stick with your existing schedule of payments to avoid any unnecessary costs.

If anyone is interested in exploring options with your respective institution, you are welcome to refer to our Mortgage Scout: COVID-19 Financial Assistance Resource blog post we’ve linked below.

https://www.gtamortgage.expert/post/mortgage-scout-covid-19-financial-assistance-resource