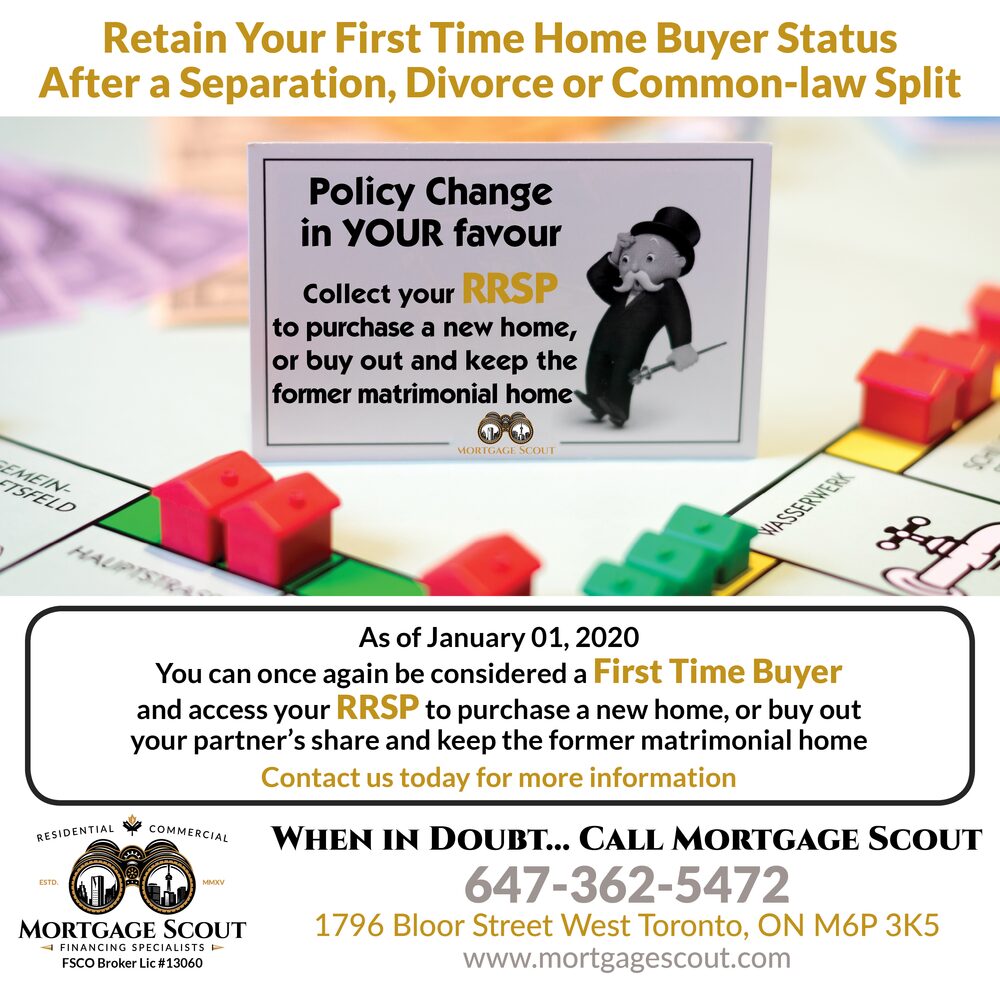

Separated and need a Downpayment? Over the years we’ve found clients taking initial steps in the divorce process encountering challenges in commencing their new life. Most notably in solving for down payment in the initial transition process. Thanks to new enhancements by the federal government, as of January 1st, 2020 the Home Buyer Withdrawal program has been improved to allow for recently separated clients to access their RRSP’s once again to gain access to a maximum of $35,000 for a downpayment.

See if you Qualify?

We’ve attached the link to the government site help you determine if you can participate in this new policy improvement. Simply download the form and answer the noted questions to see if you qualify.

https://www.canada.ca/en/revenue-agency/services/forms-publications/forms/t1036.html

https://www.youtube.com/watch?v=j7CfZoq4gwM

#homebuyer #downpayment #mortgagebroker #torontorealestate #mortgageagent #mortgagespecialist #beinformed #mortgageadvice #homebuyerprogram